Few industries are as competitive as food delivery, which features billion-dollar players like DoorDash, Uber Eats, GrubHub, and others. While usage of delivery apps has grown during the pandemic, the outcry about fees has also risen.

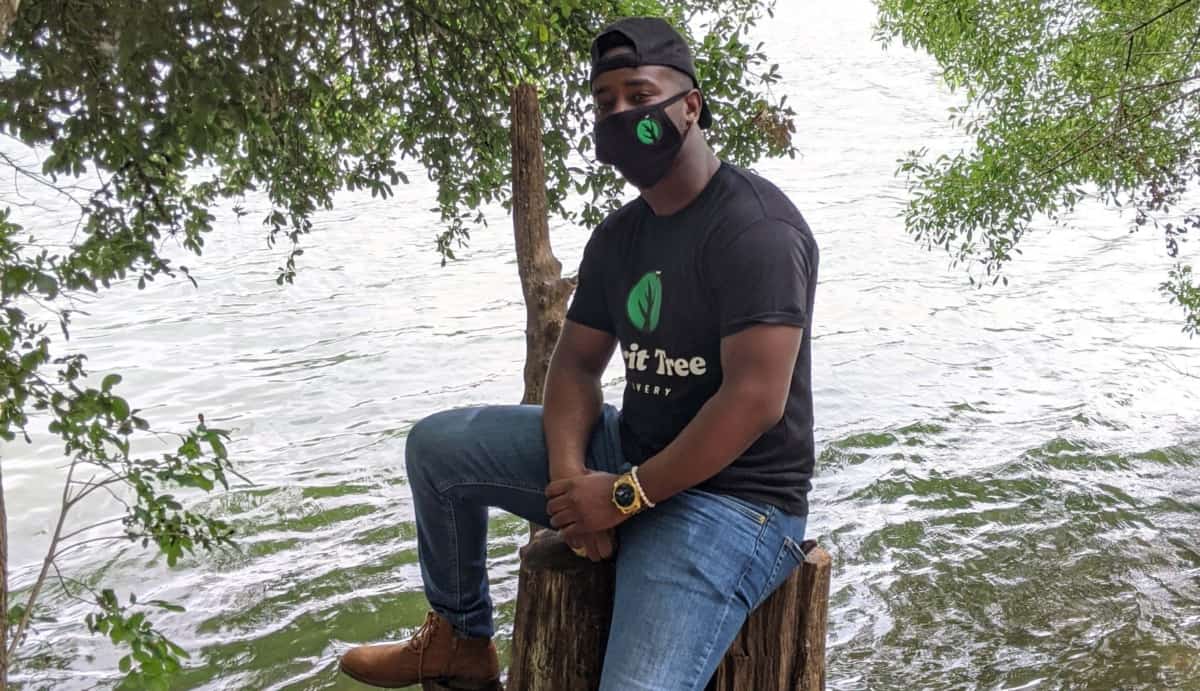

These fees and surcharges are one of the reasons why Edward D. Floyd quit his government job and stopped driving for Postmates to focus full-time on Spirit Tree Delivery, his Austin-based app that delivers food and alcohol. Floyd joined the Cover Charge podcast to discuss:

- Using credit cards and payday loans to fund his business early on

- Raising $120k from family and friends for a small piece of the company

- His company’s fee structure and value prop to consumers and businesses

- How he’s adjusted to being the boss and learned to “part ways” with employees

- His goal of delivering cannabis products once they’re legalized in Texas

Listen to the podcast episode below. It’s also available on Apple Podcasts, Spotify, SoundCloud, or Stitcher. Subscribers can check out the full transcript of our conversation. For past “Cover Charge” episodes, click here.

Cover Charge: Episode 9 Transcript

[restrict] Nick Schenck: [00:00:00] What’s up everyone? This is Nick Schenck, the host of 3rd & Lamar’s “Cover Charge” podcast. Our guest this episode is Edward Floyd. He’s the founder and CEO of Spirit Tree delivery, which is an app based in Austin where you can order your favorite food from restaurants as well as liquor from liquor stores.

And I want to start off with the fact that Edward used to work for the government, and actually his job at the government is what led him to start Spirit Tree delivery. So Edward, why don’t you just jump into that.

Edward Floyd: [00:00:35] Yeah, that’s perfect actually. Last legislative changes, which allowed for alcohol to be delivered directly to the consumer, meaning that you can get that bottle of tequila delivered directly to your doorstep, became legal in Texas. And that was in 2019. And the first license for that was issued December 2019. So we were a little forward-thinking and jumped right onto that.

Nick Schenck: [00:01:00] And what was your role in the government?

Edward Floyd: [00:01:04] Yeah, so I was a public safety coordinator, and that’s pretty much a liaison between FEMA and local and state level governments, as well as working with public disasters, such as Hurricane Harvey, cranking out grants for that, and anything in that realm of public safety.

Nick Schenck: [00:01:21] So who’s actually signing your paychecks? Was it the city of Austin or the the state of Texas?

Edward Floyd: [00:01:27] Yeah. So it was actually the Texas Association of Regional Councils, and that’s just, um, about 24 councils of governments collectively covering anywhere from five to 10 counties for each council of government.

And we were kind of the spearhead of those governments.

Nick Schenck: [00:01:44] Okay. So you had some visibility into these laws that were being passed. You were like, okay. December 2019, people can now order liquor through delivery apps. And what made you think like, okay, I better get on this, when you know, there’s Postmates, there’s Favor, DoorDash, Uber Eats, not to like call out all their competition on your podcast, but you know, it’s a crowded market, and it’s not only a crowded market, it’s well-funded.

And, and let me add this, and I could be totally off here, but my perception of government workers is they like the stability. They like the steady paycheck. It’s a safe job. Right. And so I don’t necessarily relate those characteristics with entrepreneurship, too. So talk about how all that fits together.

Edward Floyd: [00:02:35] Yeah. So the number one thing that happens, yes, there’s a stability in government and the big bureaucratic system, but what happens is, you get a millennial in government, and if you aren’t able to retain that millennial talent, we are entrepreneurs at heart. So we’re going to jump in and do something that we feel is better for us.

So it’s really just not being able to manage your entrepreneurial talent, because if someone was able to kind of cultivate me and mentor me in my role, I probably wouldn’t be where I am today.

Nick Schenck: [00:03:07] Interesting. And so talk to me about facing all that competition and you still thought, hey, this is a good opportunity. And correct me if I’m wrong, but I thought so like before December 2019, even with Favor, if I tried to order beer through the app, they couldn’t do that?

Edward Floyd: [00:03:24] They should not have been able to do that. They might have a little loophole because they do the whole runner system to where it’s typically a favor. You’re paying someone to go do that for you versus facilitating that – you’re going into the app and actually purchasing that. So Favor is a little more set up as almost a consumer-to-consumer, a friend-to-friend type of basis.

We’re simply like Uber Eats and DoorDash.

Nick Schenck: [00:03:47] Okay. So there’s a distinction between what Favor does and what like DoorDash and Postmates do?

Edward Floyd: [00:03:55] Yes. Typically they’re supposed to partner directly with that business and they’re facilitating that sale with the business. A lot of times with Favor, it’s not a direct facilitation. Those drivers are calling those restaurants, placing those orders on your behalf and picking those up.

Nick Schenck: [00:04:11] Okay. Okay. And while you were working for the government, on the side, you were a delivery driver for Postmates, right?

Edward Floyd: [00:04:20] Yeah. I was actually a Postmates driver and oddly, I was super excited to go around making deliveries as a Postmates driver.

Nick Schenck: [00:04:28] Okay. And so you had that experience, you saw this law was passed, and then you kind of sprung into action. I want to get to like some of the things you did to get the app actually launched, but, um, before that, like, how did you decide on the Spirit Tree name?

Edward Floyd: [00:04:46] Yeah, it was actually my sister who spearheaded that, and the whole Spirit Tree name started out as when we began and we were going to be alcohol and tobacco. And that’s kind of where the spirit and the tree came in. And then ultimately we did want to be the first ones in Texas to deliver cannabis products, but that’s down the line a little bit, little forward-thinking.

So you can get your alcohol and your smoking products all in one place.

Nick Schenck: [00:05:12] Okay. So you have this idea to launch a delivery app for alcohol. And obviously you’re thinking big down the line. Maybe when marijuana is legalized here, you guys can be the go-to place for that. But talk about launching the app, who did you hire? Where did you get the money to launch the app?

Edward Floyd: [00:05:33] Yeah. So as we started out, you know, in this field, you really have to have money in a sense to progress. So the biggest thing that I did was figure out how can we obtain capital and without expending all of my capital? Which that’s really how it happened. I expended a lot of my capital and then wanted to get my friends and family involved so they can make money as well, because I feel like we’re going to be big one day, and I want everyone else to make money because a lot of my friends and family and people I know never had the chance to invest in like an UberEats or DoorDash or Microsoft or a Google.

So with a company with potential, I went ahead and incorporated the company and then started selling shares almost like a crowdfunding, but within house in crowdfunding with family and friends. And that’s where I got a little bit more capital to progress forward. So we’re still underfunded, but we had a little bit of help with family and friends.

Nick Schenck: [00:06:31] Talk about the money that you put in first, before you opened it up to family and friends, like did you just max out credit cards?

Edward Floyd: [00:06:38] Oh, yeah. Well, this is something that nobody really knows, but yes, doing the whole maxing out the credit card, spending all of my money in my bank account, maxing out the savings and then to go as far as strategically using payday loans.

Nick Schenck: [00:06:54] Whoa.

Edward Floyd: [00:06:55] So, you know, the payday loans you have to pay those back, or you’re going to pay a lot more over time.

Nick Schenck: [00:07:00] Yup.

Edward Floyd: [00:07:01] So I would strategically get payday loans such as I would get a payday loan maybe on the first of the month. And then as I start to pay that one off, I would switch over and get a second payday loan from another lender, and then use some of that to pay off the loan and then use the capital to put into the company.

And it was just kind of like a robbing Peter to pay Paul type of thing.

Nick Schenck: [00:07:21] And what are the interest rates on those payday loans?

Edward Floyd: [00:07:25] Oh, ridiculous. I can’t even put my finger on it, but typically if you’re getting a thousand dollars in a payday loan, you’re probably paying anywhere from $1,500 to $2,000 back.

If you do it over the recommended amount of time. But if you pay it back sooner, you’re spending a lot less.

Nick Schenck: [00:07:44] And do you mind me asking, what were you getting paid in your government job?

Edward Floyd: [00:07:48] Um, I was making quite a bit, a little bit for a new graduate. I was making about $55,000 and then with the military. So roughly I was bringing in about $65,000 a year.

Nick Schenck: [00:08:00] Okay. What’s the military then you mentioned?

Edward Floyd: [00:08:03] Yeah, so I’m actually in the National Guard.

Nick Schenck: [00:08:05] Okay. Got it. How long were you trying to do – like parallel path it – before you decided to just do only Spirit Tree delivery?

Edward Floyd: [00:08:15] Well, my plan was to – because we did all the paperwork and everything in January. So my plan was to go possibly until March, you know, until that spring timeframe.

But, um, you know, it started overtaking my time and it required more of me to where I actually prematurely left my job in February and was just bootstrapping it like crazy.

Nick Schenck: [00:08:38] Okay. And for people listening to this who have started their own business or who were thinking about it. Typically a lot of businesses, they start as LLCs, but if you want to raise money through family and friends and give them a piece of the company – from what I’ve learned, doing that in an LLC, there’s some issues. I think that anyone who has shares in an LLC, I think they get a voting right. I’ll bring a lawyer on at some point to explain that, but I’ve heard that, and like what you went through, kind of confirms that. So talk about that process.

Edward Floyd: [00:09:15] Yeah, that’s actually a great talking point because we were an LLC for about a week, and going through that, those channels, that’s when I realized we need to go ahead and incorporate this company, because like you said, with an LLC, technically with an LLC, you’re not getting those shares. You’re buying a percentage of the company, if you were to take money. And really you’re not buying a percentage of the company. You’re awarded a percentage. So you have a hundred percent of the company and anyone you bring in at the beginning, you’re kind of breaking it up like a cake. Versus when I incorporated, now I have my cake and I can take my pieces of cake at any time and start selling those pieces off.

Nick Schenck: [00:09:56] Yep. Got it. And to save money, you went to the library and basically did all the research yourself on how to make that change versus hiring an attorney. Right?

Edward Floyd: [00:10:09] Exactly. So everything we’ve done was in-house from our TABC applications, I did that all myself with no prior experience with the applying for liquor licensing. And with the business licensing and everything like that, just me being a fan of the library, I went to the library and checked out about 12 books and sat through all nights, multiple nights and just going through and putting things together.

Nick Schenck: [00:10:35] That’s awesome. And you’re saying “we” a lot. Talk about who else is in the company.

Edward Floyd: [00:10:42] Yes. We are very small. Um, I say we, even though everyone does not tackle the same problems that I do.

But I’m just very team-oriented that anyone that had a little piece of anything is part of the “we.” So right now into the C-suite you have me, of course. And you have a good friend of mine who is kind of occupying that operations officer’s standpoint. And then of course you have my girlfriend, who actually works for Microsoft. And that’s where I get a lot of my help from in the technical aspect. And then I have another friend who is kind of like an understudy who’s working with us. So once we grow and jump into like a market like Houston, she can like take everything that she’s learned from me and under my leadership and grow Houston.

Nick Schenck: [00:11:29] Okay. What’s it like working in the same company as your girlfriend?

Edward Floyd: [00:11:35] Um, Yeah. So that was a headache in itself. I mean, we both understood the common goals, but, um, it was different for her because she always told herself she’s a software engineer. She was like, I never want to work for a startup. I don’t want none of that headache, none of those problems. And then lo and behold, I started a startup, and she tells me all the time, I never want to work for a startup, but I’m only doing this for you.

Nick Schenck: [00:12:03] That’s funny. So did she develop both apps like the Android and the iPhone app?

Edward Floyd: [00:12:09] Yeah, so we actually both went hand in hand on that. Um, and we pretty much use a content management system to kind of put that together. I’m limited to HTML, but she has a more expansive list of languages that she’s good with.

Nick Schenck: [00:12:22] Okay. So in February ,you quit your job, dedicate all your time to Spirit Tree. Um, are you taking a paycheck at that point or are you just putting any money you guys make back into the business?

Edward Floyd: [00:12:37] Yeah, so I received my last paycheck, I want to say March 1, I believe. And from that point on, it’s been every dollar I can get my hands on, and every dollar that we make, gets reinvested into the company.

Nick Schenck: [00:12:52] And so you’re surviving off the money that friends and family invested?

Edward Floyd: [00:12:57] Um, at this point it became more of a, whatever I’m able to make from the military. And a lot of my odd jobs that I do on the side, because the initial investment that we received from family and friends, that helped push us over the hurdle of obtaining our licenses.

Nick Schenck: [00:13:13] Got it.

Edward Floyd: [00:13:14] So now it’s like, yeah, straight profits are just getting regenerated.

Nick Schenck: [00:13:20] What are those odd jobs that are bringing in money besides just doing the National Guard stuff?

Edward Floyd: [00:13:27] Yeah. So, um, I actually mount TVs, so various people have contacted me to mount their TVs. Some people will get like two or three TVs mounted in their houses. And I’ll go do that, as well as other handiwork and other business solutions. Through working through Spirit Tree, I was able to kind of develop an experience that people value as far as doing TABC applications for other businesses who are looking to sell alcohol. And that’s a very expensive field.

Nick Schenck: [00:13:55] Interesting. We did a story on 3rd & Lamar about the fees that a lot of these other apps charged. So app companies that we’re talking about, DoorDash, Uber Eats, GrubHub, et cetera. They typically take like 20-40% of an order. And sometimes they charge marketing fees for restaurants to be featured and on top of that, I know GrubHub charges like a 3% plus 30 cents per order processing fee. So, you know, I think this came to my attention because earlier this year, there was like a viral GrubHub invoice that a restaurant owner in Chicago posted, and it showed like their gross sales and then like what they actually netted after all the fees and promotions and discounts. And it was eye-opening to say the least.

So I think like you went into this, not only seeing the opportunity with alcohol delivery, but you notice these delivery fees that other apps charge, ultimately, the restaurants have to charge more. So it gets passed to the consumer. How do you guys make money?

Edward Floyd: [00:15:01] Yes. So we make money ultimately by, well, just to back it up. Once we started jumping into the food realm, the food delivery realm, um, our mindset was what can we charge that everyone is comfortable with and that’s not going to overcharge the customer as well?

Nick Schenck: [00:15:22] Okay.

Edward Floyd: [00:15:22] And that’s when we did the research of exactly what everyone’s charging from Uber Eats and DoorDash, and then really figured out where we can go.

So we actually took ours down to 15% and that’s a happy medium for a lot of places. It’s 15% versus a GrubHub and DoorDash, a lot of them are going to charge at a minimum 25% and that can go up to about 35%, sometimes 40%. And that’s nowhere near the profit that those companies are seeing because they charge a lot more fees on top of that, that get passed onto the consumer.

Nick Schenck: [00:15:55] And let’s say I order a hundred dollars worth of food from y’all or liquor. So I’m basically paying $115, but it’s based on where I am, right? If I’m out in Leander, the delivery charge is going to be higher, right? Than if I’m in Central Austin?

Edward Floyd: [00:16:12] Yes. Well, actually with that order, let’s say it’s a hundred dollars and tax is included. So you’re at flat at a hundred dollars. You as a customer, you’re only paying a hundred dollars plus that delivery fee. So if you’re about 10 miles away, it’s $110 and that’s it.

Nick Schenck: [00:16:28] Okay. And then I order, let’s say I order that liquor from, um, Spec’s. What Spec’s paying you for that, for facilitating that sale?

Edward Floyd: [00:16:40] Okay. That would range, but it would probably be for that sale there, it would probably be $8.

Nick Schenck: [00:16:46] Okay. I imagine you have a ton of people reaching out to local retailers about getting on Spirit Tree. Explain that process.

Edward Floyd: [00:16:57] Oh, well let me break the bad news to you with that one.

Nick Schenck: [00:17:02] Okay.

Edward Floyd: [00:17:02] We don’t have a ton of people. It’s literally – so every restaurant and liquor store that we have so far, I’ve been in contact with them. And I specifically facilitated that, getting them on. So from recruiting to onboarding, a lot of that is what I’m doing.

Nick Schenck: [00:17:21] Okay. And what’s the typical response you get when you reach out to someone? Like, I think I saw Sarah’s Mediterranean Grill is on Spirit Tree. When you contacted them, were they like, who? Or give me the typical conversation.

Edward Floyd: [00:17:38] Yeah. So I like to say you have a left and a right conversation. You know, you have, um, some business owners who are familiar with delivery services, and then we come along and we tell them what we’re about. And they’re gung ho like, can we start today?

And then you have other restaurant owners and liquor store owners who are like, well, y’all are new. And even though y’all are better than what we have, we really don’t want to switch over or add y’all to our services, which is perfectly fine. They’ll come along with time, but it’s, it’s usually a, a straight hit or miss with no in-between.

Nick Schenck: [00:18:16] Well, why what’s the downside? Like if they’re already working out deals with GrubHub, Uber Eats, et cetera, just adding another delivery service to the mix, I don’t understand what the risk is for them.

Edward Floyd: [00:18:30] There is no risk – to be frank. There isn’t one. Um, one thing that we do that it takes some stores a little bit of time to kind of get into know and fully understand is that we care about your brand more than these other service. And we take on your brand as if it’s our own.

So when we’re interacting with your customers, or we bring our customers to your site, we’re very, very attentive to everything that we do. Versus the larger companies, they just list you. They don’t care, whatever happens, happens. And that’s where you get those negative reviews from.

Nick Schenck: [00:19:06] Okay. Interesting. So what have you learned about consumer behavior since COVID hit in March? I know you launched the app in January. You decided to do it full-time in February, COVID hits in March. Everyone starts ordering through delivery apps, but local restaurants are also shutting down left and right. Have you seen it as like, in terms of just specifically your business, COVID’s helped you, or it’s been more difficult because just more restaurants have shut down, places aren’t really operating at full capacity?

Well, for us, the pandemic, you think it would have been something great for us, but with launching in the pandemic, it became kind of a hurdle. Because now everyone is gravitating to these other services, and then us coming in and kicking in the door, it’s like we have to kind of re-sell delivery all over again to these restaurants who might’ve been burnt out by other services through negligence, such as drivers eating the food, drivers never showing up.

Edward Floyd: [00:20:13] So it’s, it’s kind of like breaking those doors was a little bit harder in a pandemic for us. But once we started breaking those doors open, and the name started getting out there, and people started to see, okay, these guys are about business and then they’re doing business with a smile, and that’s kind of ease things, ease attention for us.

Nick Schenck: [00:20:34] Okay. And how did you get the drivers on? Like, if I’m a driver, no offense to Spirit Tree, but I’m like, you know, DoorDash, Postmates, GrubHub, et cetera, are established. There’s probably a ton of volume through those apps. Like I could probably make way more there. Tell me why I’m wrong.

Edward Floyd: [00:20:53] You’re not, and actually, um, when we were first bringing on our drivers, we were letting them know, like, it’s perfectly fine if you’re doing Spirit Tree and other delivery services, like we’re building up and we’re growing and we’re definitely going to treat you better than these other services, such as we do guarantee at a minimum you’ll make is $10 a delivery. Now the other services, they can’t guarantee that every delivery, you’re going to make at least $10, but what they can guarantee is that you’re going to have maybe 20 or 30 deliveries. And that’s kind of like iffy in itself. So the biggest thing we have is transparency. You know exactly the leadership of the company, you know exactly what’s going on. If you ever have any questions like, hey, I’m not getting any deliveries. You have a direct contact to where you can reach an actual person.

Nick Schenck: [00:21:46] Okay.

Edward Floyd: [00:21:47] When I worked for Postmates, I didn’t have that. It was just, I would drive around and hope to get a delivery, but I never had someone to tell me, hey, delivery is going to be extremely slow right now, or, hey, we’re going to have a pickup at this time. If you’re available, we’ll make sure to push deliveries your way.

Nick Schenck: [00:22:04] How many drivers do you have right now?

Edward Floyd: [00:22:07] Right now, we have about 30 drivers that we have in our vault that we kind of push around.

Nick Schenck: [00:22:12] Okay.

Edward Floyd: [00:22:12] So they’re not always active at the same time, because we like to mitigate to make sure that the delivery volume and the drivers are kind of close to each other.

That way one’s not tipping a chart. We have too many drivers, not enough deliveries, such as is a problem with all the other services are too many deliveries, not enough drivers, which that’s a problem I would love to have, because we can kind of add more drivers as we go.

Nick Schenck: [00:22:36] Yeah. And from the outside looking in, you know, my thought about a delivery company is there are a lot of logistical hurdles and forecasting demand, I imagine that’s challenging. Um, you know, even just getting the order right. When we wrote that story on restaurants and their relationships with delivery companies, one of the biggest complaints we heard is the orders constantly get screwed up. Right. So how do you guys handle the logistical side and all the moving parts that go into it when you guys are such a lean operation?

Edward Floyd: [00:23:12] Yes. So, um, well just to backtrack, you know, the relationship with delivery service and the restaurants, it’s non-existent. It does not exist. And when we come in, we actually build that relationship, that partnership with the restaurant. So internally we ended up knowing the menu back and forth as if we do work in the restaurant.

So when we put that menu on our site, it’s just as if you are in person ordering from that restaurant. And then on top of that, what really mitigates everything is we have a four-way chat. So the minute you complete your order, you’re entered into a four-way chat in our app. And that four-way chat consists of the Spirit Tree admin, which is pretty much a dispatcher. Then you have your driver, your restaurant, either the owner or a staff member is on that. And then yourself. So everyone is in the same revolving door in conversation, just kind of talking to each other, such as if you wanted more ranch, you literally can be in the chat and say, hey, can you add more ranch and some extra napkins?

And somebody is going to catch that to ensure that you get more ranch and napkins.

Nick Schenck: [00:24:26] Yep.

Edward Floyd: [00:24:27] So it’s just very transparent.

Nick Schenck: [00:24:29] And that doesn’t exist when you were with Postmates? It’s just basically the driver and the person who ordered?

Edward Floyd: [00:24:35] Exactly. There’s no interaction from the business owner or a staff member to say, hey, we don’t make this with the sauce anymore. We stopped that a month ago. Well, with Spirit Tree, if something like that happens, which is highly unlikely, very highly unlikely. But if something like that happens, that staff member can hop on the chat and say, hey, we don’t make that with that sauce, but we do make it with ketchup. Would you like it with ketchup or without ketchup? And instantly you can have that conversation.

Nick Schenck: [00:25:08] Got it. About a month ago, when we were speaking, you said you’re doing, you know, five to seven and it could be up to 10 to 12 deliveries a day. Um, is that still the case or how many deliveries a day are you doing now on average?

Edward Floyd: [00:25:21] It ranges. So I would say, yeah, it’s still about the average of like 15, you know, we don’t have a lot of restaurants. I really feel that once we reach to maybe a hundred restaurants, then we have our customer base that’s like, yeah, we want to order from Spirit Tree every day, because now we have more options for you, and you don’t have to order from the same places every day.

Nick Schenck: [00:25:41] Yup. Okay. So about 15 a day, um, what, what’s the number one place people order from right now?

Edward Floyd: [00:25:50] Uh, right now. So everything switches over from week to week, but right now, Soju Korean Kitchen and Bar, it seems to be the go-to. They actually won best fried chicken in Austin. So, um, they’re, they’re typically the go-to right now, it’s where a lot of customers are ordering from.

Nick Schenck: [00:26:06] Okay. And is it mostly food delivery right now, or is, do you do equal parts like food delivery and alcohol delivery?

Edward Floyd: [00:26:15] I would say equal parts because, um, you might have like a Friday night to where everyone just orders food. And then a Saturday night where everyone orders a little bit of food and a lot of alcohol.

So it it’s, it’s inconsistent and kind of sporadic.

Nick Schenck: [00:26:30] Okay. So I just want to go back to something you said earlier. Um, initially when you launched this, you thought about alcohol and tobacco products. Um, but also down the line marijuana, um, I think one story that maybe hasn’t gotten covered as much as others during the last, um, the most recent voting is how many states now have legalized recreational marijuana.

Texas is not one of those states, but do you, from having worked in the government in Texas, do you know something maybe the general public doesn’t know about the appetite here for that? Do you, do you see something coming up on the horizon soon where you feel like marijuana will be legalized and this is going to be a big part of your business, perhaps the biggest part of your business?

Edward Floyd: [00:27:19] Yeah. I actually feel that, um, that things will change. It will probably take about four more years. So our next legislative session, I don’t foresee anything getting pushed through during that session, but I do foresee the door kind of getting broken down a little bit for the future session that allows for recreational use of marijuana.

Nick Schenck: [00:27:41] Okay. You talked about expanding to Houston, what other plans for expansion do you have and, you know, do you get demand from other cities? Do you have people saying, Hey, I wish you guys were here or wish you guys were servicing here?

Edward Floyd: [00:27:57] Yes from all standpoints. So from a consumer standpoint, um, we have people contact us all over saying, uh, when are you coming to this place? We really want you to come to like San Antonio. We want you to come to Dallas. We want you to come to Cleveland. Why aren’t you in Florida? We get those from customers all the time. Um, and then from a business standpoint, businesses have contacted us and wanted us in their area. We actually are about to go live with a liquor store in Dallas, just finished setting that up. We should be going live this week, possibly right before Thanksgiving. That owner, he pretty much said I’m using Drizzly and Minibar, but I want Spirit Tree. And when somebody really wants you, you find a way to make it happen.

Nick Schenck: [00:28:43] Okay. Yeah. One thing I’ve noticed about all these delivery companies is, you know, the reason why they’re so capital-intensive is because of their customer acquisition costs, they funnel a ton of money into ads.

Um, you guys obviously don’t have that budget. What have you learned about customer acquisition and like, what are you willing to spend to drive a new install of your app right now?

Edward Floyd: [00:29:07] Well, typically a lot of our marketing is it’s different from, you know, those well-funded companies. We’re really coming from the bottom up and keeping our cost mitigation pretty low.

So for us to acquire a customer, it would probably cost fractions of someone else’s budget. So we might get an install and it might cost us maybe $3 a customer, which is crazy versus, um, you know, a Drizzly or Minibar or Uber Eats, they may spend like $150 just to get one customer.

Nick Schenck: [00:29:39] Yeah. I’m sure they have customer lifetime value calculations that, and they may be willing to lose some money to gain market share.

But so you’re spending $3. Explain where that money’s going. Are you talking about $3 in terms of like Facebook ads or are you talking about $3 like when you look at all of your overhead and you put that over how many installs you have, it works out to about $3?

Edward Floyd: [00:30:05] Yeah. So it ended up working out to about $3 when you actually put the numbers down on paper. So let’s say we might spend like $400 on an advertisement. Right. And then over time we may have like 300 installs just from that – maybe from that advertisement, maybe from one that we actually spent $20 on. So it kind of averages out when you put it together and it’s like, oh, we have all of these customers and give and take, there is a human error of some customers who haven’t encountered any of our ads, but have downloaded the app.

So you have that little error in there which actually brings it down to about $3.

Nick Schenck: [00:30:42] Yeah. Um, what about the average age of people that are ordering from you? What what’s that you seem like mid twenties to mid thirties or what?

Edward Floyd: [00:30:54] Yeah. Our average age is 25 to 35.

Nick Schenck: [00:30:57] Okay. Male or female majority?

Edward Floyd: [00:31:01] The majority female. Um, for some reason, the ladies love us.

Nick Schenck: [00:31:09] Oh, so what, what do you think is the hardest lesson you’ve learned so far?

Edward Floyd: [00:31:17] The hardest lesson I’ve learned was to stop, you know, desiring for venture capital and these big budgets, and really just figure out how to make what you have work. And it’s, it’s easier said than done because you’re fighting these billion-dollar companies, but our value really speaks for itself.

Nick Schenck: [00:31:43] And have you been approached by investors?

Edward Floyd: [00:31:47] Um, not large level investors. Um, I’ve had a couple of conversations with a few, but nothing really takes off because with, like you said, with all of these billion-dollar companies, it’s like, all right, well, talk to us when you have more traction, when we do this, when we do X, Y, and Z. But when that happens, when we grow and let’s say we take over the whole city of Austin. I mean, we’ve been bootstrapping and it’s like, we don’t need a venture capitalist to progress our company in other cities. We can just continue doing what we’re doing.

Nick Schenck: [00:32:18] Yeah. And so early on, were you thinking, okay, we just need a little bit of traction, then I can like raise some money from investors because maybe you thought that was the playbook other apps use. So you had to follow that playbook. And then what, what was the light bulb moment where you said like, that’s actually not what we need to do?

Edward Floyd: [00:32:38] Yeah. So, um, that exactly was the playbook. I thought it was because if you look at the history of all these other companies, they have the seed round and they have the series a and they just keep progressing and receiving millions of dollars at each level.

And at one point in time, I was pretty upset. I was like, man, if we were someone else, we would get all of this money just to be where we’re at right now to progress. But that moment really came when the customers we had in the beginning were using our service. And they were just really complimenting us and telling us like, we love what you’re doing. Like your customer service, the attention to detail that you spend on a customer is exceeding what I’ve ever had done from other services, which kind of, that was the light bulb moment of, okay, if we’re making this impact with nowhere near the budget that everyone else has, then, you know, maybe we have something golden that we can just keep refining and building and growing. And really pride ourselves on.

And that was customer service. Something that we have that I believe no one else is doing is emphasizing customer service. And internally that turns into, you know, a million-dollar company.

Nick Schenck: [00:33:48] So a lot of people say, okay, it sounds great to take money from friends and family, but then, you know, remember you have to face them when you sit down for Thanksgiving. So Thanksgiving is coming up. Um, and we may have this actually published after Thanksgiving, but we’re going into Thanksgiving this week and you’re about to, you know, I imagine you’re going to talk to family and friends, if not sit at the same table, is that uncomfortable for you or are you like they’re, they’re just real supportive? Are they going to be like, well, tell me how the company is going? Is it going to be awkward at all?

Edward Floyd: [00:34:21] No, not at all because one, um, no one has really gave us that large level amount to where it’s like, Hey, I emptied out all of my savings and bank accounts for you. You know, it’s really everyone. We kind of nickeled and dimed like, hey, this guy gave us a hundred dollars. My cousin gave me like $50 and then we kind of added everything up from there. But I set the standard from the beginning that this is an investment, you’re investing in this company. It’s not a loan. You’re not giving me money. You own some of my company. And you are an investor when you have that line and you don’t cross that line and you let everyone know you’re investing in my company.

Now, you’re owning a piece of it, but you’re not running this. So just sit back and let me turn your $50 into maybe one day $5,000, maybe $50,000 one day. But this is ultimately a risk. You take a risk when you make any investment, we’re just a private company. We’re not public.

Nick Schenck: [00:35:20] Yup. And explain how much of the company you gave away.

Edward Floyd: [00:35:27] Well, I didn’t give it away. I sold it.

Nick Schenck: [00:35:30] You sold it, but yeah. How diluted are you?

Edward Floyd: [00:35:34] Um, Take a guess. I’ll let you take a guess.

Nick Schenck: [00:35:37] Okay. Well tell me how much you’ve raised and then I’ll take a guess.

Edward Floyd: [00:35:41] How much I’ve raised, I want to say a little bit over like $120,000.

Nick Schenck: [00:35:45] Okay. My guess is you gave a third of the company away – maybe a little less, 20%?

Edward Floyd: [00:35:54] Dang, that’s pretty good. That is pretty good, actually.

Nick Schenck: [00:35:57] Okay. So that’s, that’s pretty accurate?

Edward Floyd: [00:36:00] Naw, 3%.

Nick Schenck: [00:36:02] Okay. That’s great.

Edward Floyd: [00:36:06] That’s rounding it up. That’s rounding it up. It’s really about like 2.9 something.

Nick Schenck: [00:36:11] Okay. So you gave up 3% of your company for $120K. I’ll try to do some quick math, but that values your company at multiple millions of dollars.

Edward Floyd: [00:36:23] Yes.

Nick Schenck: [00:36:24] So explain to me how you were able to justify that valuation?

Edward Floyd: [00:36:27] Yeah. So, um, with that, it’s really just with the market and what we can get out of the market and based on our overhead in comparison to the overhead of other companies. So one of the biggest ones was DoorDash. The volume that DoorDash is doing.

Internally, we’re looking to one day have roughly 6,500 businesses in Austin. And if you make X amount of dollars for each business per day, that literally puts you more than what we’re actually valued at. And it was literally like $10 million is what we kind of started out with. And that’s basically like a dollar a share, roughly give or take.

Nick Schenck: [00:37:12] Okay. So it was based on the opportunity versus what your actual numbers are right now?

Edward Floyd: [00:37:20] Yup. That’s exactly what it is. Cause you’re investing in a person ultimately with the startup, you’re investing when, how much you believe in this guy and his idea. So we actually could have charged more, but I felt like a dollar was very reasonable because if we’re not at that anywhere close to that at the end of our vesting period, then it’s almost like, hey, what have you been doing for three years?

Nick Schenck: [00:37:42] Okay. Well, I mean, if you’re getting that type of valuation, kudos to you. And you didn’t, you didn’t hire any attorney, right? You basically did all the paperwork yourself?

Edward Floyd: [00:37:54] Exactly. From filing our company with the SEC, doing it stateside at secretary of state, going through all of those legal hurdles. Went through that.

Nick Schenck: [00:38:04] Okay. What, you know, when you look back since February, since you decided to do this, full-time, um, give me a sense, like the most discouraging moment. And then I want to hear about the moment where you were most elated, I guess the highest of the highs.

Edward Floyd: [00:38:23] Yeah. So the most discouraging moment for us was, was for me, it was very recently, it was, I want to say it was May, that May timeframe.

And that was like my target month where everyone else would start receiving their licenses to deliver alcohol. So we were, I want to say we were one of the first, roughly about the first 10 companies to get their, their delivery license. But I was waiting for a couple more licenses and I just felt like, Oh, all this effort was kind of like wasted because now the billion dollar companies are, are doing what we’re doing.

And they have these huge budgets to just take over the market and they can drown our ass and just drown out ultimately Spirit Tree in itself. So it was pretty discouraging at that time. And I was like, well, like what, what can, what can we do now?

Nick Schenck: [00:39:16] You just thought like, all right, they beat us to the punch and now like we don’t have that first mover advantage, they’re way ahead of us, right?

Edward Floyd: [00:39:26] Exactly. Exactly. Now, since they have the capital, they can, we’re good now to jump ahead and shoot to the moon, but it was really our customers that did it for me. It was one customer in particular that was just like, man, I want y’all to have every place that I order from, because I order delivery every day. And if y’all had all of these restaurants, I would order delivery from y’all every day.

Nick Schenck: [00:39:52] Yup. That just shows you’re onto something. I think one thing that’s helped to us with 3rd & Lamar or at least me personally, is, , somebody had mentioned to me, I forget if it was a friend or family member is like, just don’t pay attention to somebody else’s scoreboard.

That’s not your scoreboard. And so it’s easy to play the comparison game. And to think either about your competition or maybe how well somebody else is doing with their business, their venture. I think it’s, everyone’s playing a different game. And even if they’re in the same industry as you, that’s their scoreboard, not necessarily your scoreboard.

Um, that’s always helped me kind of just remain focused on what we’re doing and like our timeline, because our timeline isn’t going to match necessarily everyone else’s. And honestly, you’re playing a very different game than DoorDash, Uber Eats, you know, on the surface people will be like, Oh, you know, they’re both delivery services, but once you start taking a ton of money from institutional investors, VCs, whatever, you know, it’s a very different game than a company that’s bootstrapped, you know?

Edward Floyd: [00:40:56] Exactly. You have, uh, a lot more things to answer to versus, you know, a family member. You can sit down and have that conversation. Or a friend could sit down and have that conversation.

And they’re an understanding like, Hey, it’s going to be about three years before you see any profit. So don’t expect nothing crazy.

Nick Schenck: [00:41:14] Okay. So you went from government job to just flying by the seat of your pants as an entrepreneur. What was the hardest adjustment for you and, you know, going from where things are slow moving, there’s a lot of bureaucracy to like, you’re just relying on yourself and making decisions at a moment’s notice. What’s that adjustment been like?

Edward Floyd: [00:41:40] Well, one of the adjustments, cause I’m a very light-hearted person that likes to see everyone happy. And the biggest adjustment for me was ultimately being a boss and that’s not being like bossy or anything. It’s just learning how to be a CEO, be the person in charge and not take that to heart.

Because when I first started, you know, just working with people, you know, I kind of like tip-toed, like, hey, I need this thing done. And can you help me with this? Versus now I’m a little more, I need X, Y, and Z done. And if X, Y, and Z can’t get done, let me know. And I’ll find someone else to do it, or I’ll do it myself.

And you kind of have to be that way if you want to progress and grow. Without that, you kind of impede your success.

Nick Schenck: [00:42:33] Have you had to fire anyone yet?

Edward Floyd: [00:42:37] Um, I call it parting ways.

Nick Schenck: [00:42:42] Okay. So tell me about how that went? How many people have you parted ways with, and tell me about the experience of the first time you did that?

Edward Floyd: [00:42:52] Yes. So about three of my core team members we parted ways with, um, one, it just wasn’t the best thing for her. I guess she didn’t understand really how the startup lifestyle is. You know, there’s not going to be a lot of structure. You may expect an update every week, but for someone who’s doing almost everything, you’re not going to get an update such as how much you’re getting for your time. You’ll probably have a contract starting out, but it’s up to you to take it on yourself, to refer back to your contract versus expecting me to tell you every week an update of like, Oh, this is how many shares you have or are awarded for your work, you know?

Nick Schenck: [00:43:36] Oh, because it was someone you were paying in like, uh, equity versus any cash?

Edward Floyd: [00:43:41] Exactly. So that was, that’s what it was. I wasn’t able to give you an update, but I gave you a layout from the start.

So from the start, you know, from this day until the next contract, you’re getting this many shares. So in a typical job, you get a paycheck and you’ll get your stuff, you know, every month or every two weeks. In a startup, it’s like, no, just refer back to your paperwork. I have a thousand things going on and, and being HR is not one of them.

Nick Schenck: [00:44:16] The first people you hired were they, obviously your girlfriend’s working with you, but were they mostly your friends?

Edward Floyd: [00:44:22] Yeah. So it was, uh, yeah, mainly friends. That’s what I reached out to was I wanted friends of mine to one day, you know, work with the company and even friends of a friends. But that was, that was just one of the things that kinda kinda didn’t work out.

And it’s not because it’s a friend or a family. It was mainly through understanding what it is to work in startup culture.

Nick Schenck: [00:44:45] Yup. And yeah, it’s, there’s not a lot of structure, a hundred percent agree with that. And, um, yeah, the feedback may not be as regular as a typical job, especially maybe a government job.

Yeah. Um, okay. So when I think about what you guys have built, you know, the, the local angle is something that you guys are really emphasizing. It’s a big differentiator, especially in Austin. People love local, and there’s a huge emphasis on local here. Um, it’s funny. I don’t live too far from that chili’s on 45th and Lamar and yeah.

Lamar. I’m like shocked that it’s still open. Because like a Burger King shut down. People don’t like franchises, especially in Central Austin. They like local. And, um, so in your marketing, you’re talking about local quite a bit. Uh, talk about, you know, How you think about your positioning in your marketing and how you’re trying to weave Austin into your brand?

Because, you know, I did see a graph or a chart on your Instagram showing like, Hey, when you buy from DoorDash or Uber Eats your money goes outside of Texas. And when you buy from us, it stays in Texas. So just explain your approach.

Edward Floyd: [00:45:59] Yeah. And that’s actually fairly recent, you know? Because when I was thinking about building a company, yes. I’m like, yes, we’re, we’re local. We’re probably one of the only companies that’s a Texas corporation. So I didn’t shoot out to Delaware to make a Delaware corporation. I actually took the time to understand what it takes to be a Texas corporation. And that’s very rare. You’ll see in any startup culture, the, the standard of being a startup is to start a Delaware company.

Nick Schenck: [00:46:26] Besides the fact that you’re prideful about being from Texas, there’s gotta be some trade-offs in becoming a Texas corporation versus a Delaware?

Edward Floyd: [00:46:36] Well, for someone who’s bootstrapping, it’s easier to navigate and find those pitfalls within, uh, Texas, you know, um, uh, can talk right now, but yeah, to like actually setting up as a Texas corporation.

Because you live here. You’re from here. I spend time at Texas government. So that’s what I know. I know Texas. If I were to jump out to Delaware, I would have had to hire more lawyers, get all of these business people in place to help me become a Delaware corporation, which a lot of venture capitalists prefer that.

But hey, it’s one of those things where I was just like, no, how about we just put our money where our mouth is, we’re Texan, we’re doing Texas stuff. So be a Texas corporation. And that’s another angle that keeps our money in Texas. When we make money, we’re paying business taxes, paying money to the state, and then it just keeps revolving.

So that whole circle of, of the dollar that you kinda hinted on when, when we actually make money, we’re spending money locally, all of our money is spent in Texas. For the most part, we’re trying to get more companies that we can use in Texas. But for the most part, we’re staying here local, such as when we have our face covering or a mask, we actually had a local person make those.

And we were buying those for all of our drivers, getting our shirts made. We’re getting those made locally at, um, an Austin company. So it’s like when we make money, we’re spending money right back into the community. It’s this little ecosystem of dollars just keeps revolving. Now other companies, they might buy similar things that we’re buying. But they’re not buying them in Texas. So why not use the Texas people with the Texas dollars?

Nick Schenck: [00:48:24] Yeah. Okay. How long can you keep this up? Where you’re not taking a paycheck and you’re just surviving off National Guard and surviving off other jobs, um, side jobs?

Edward Floyd: [00:48:36] Um, so yeah. Well, regardless of what happens, I plan to have done this until May 1, 2023. Okay. Like that’s, that’s the plan, but I do foresee myself being able to have a paycheck within the spring, just by our projections.

Nick Schenck: [00:48:52] Okay. May 1, 2023. Why is that like the end of your vesting period?

Edward Floyd: [00:48:57] Yes, that’s the end of the vesting period and, and we don’t have any guarantees with ours, but I did make promises and in my word, everyone that invested in me already were people that believed in me and believed in every word that I’ve gave them, because they had seen my work ethic throughout my life.

So if I promise one thing, you can guarantee that it’s going to happen, but legally I can’t say guarantee.

Nick Schenck: [00:49:18] What is your forecasted revenue for 2020? And what are you forecasting the growth for 2021?

Edward Floyd: [00:49:25] All right. So yeah, for 2020. Yeah, that number is pretty low. I don’t even want to shoot that out on, on the, on, on the record, but cause it’s really, we’re still, we’re less than a year old and less than even six months old.

And in a sense, if you’re not counting our soft launch to where we were ironing out, the, the nicks and the kinks in our system, technically we’ve only been hard launch since July.

Nick Schenck: [00:49:56] Yup. And so give me a sense of your percentage, like forecasted growth for 2021?

Edward Floyd: [00:50:05] 2021. Yeah. See, that’s going to even sound crazy as well since we’re jumping out there.

So 2021, I mean, I expect to be at about a thousand businesses. So coming from, you know, one to a thousand. And even at the end of the year, we’ll probably be at what, like 35 or 40 businesses. So let’s say from 40 to a 1,000, that’s going to be a huge percentage. That’s going to sound almost unicorn, right?

Nick Schenck: [00:50:31] Yeah. Like 2000%, 4000%, something like that. Um, okay. I understand not wanting to give up your revenue figures, but what about total expenses in 2020? What do you expect that number to be?

Edward Floyd: [00:50:43] Total expenses? Well, let’s say, hmm. Total expenses. Actually, I can spitball that right now actually give me a second, actually, I expect to spend, um, to go up to about a thousand businesses and through the marketing and all of that with that, um, probably about anywhere from like $70k to $80K.

Nick Schenck: [00:51:10] That’s your expenses for 2020 end of year?

Edward Floyd: [00:51:13] Oh, no, sorry, expenses for 2020? Okay. Yeah, that’s going to be through the roof because we have to pay for our licensing and, um, all of our space lease and all of our equipment, because we do pay for the equipment for the businesses. That $70k to $80K that would actually be for 2021, our expansion period.

Nick Schenck: [00:51:32] Okay. So 2020 expenses are way higher, even though you’re going to be expanding in 2021.

Edward Floyd: [00:51:40] Yes. And with that is, cause you know, you have the acquisition of getting everything you needed to build your apps and then you have your licensing. And of course you have to pay all of the expenses of incorporating your company within the state, as well as paying the national companies to actually be legitimized and selling your shares, and then you have to pay that locally to sell shares. And it’s, it’s an ongoing list of costs that we have to go through this whole year and to nickel and dime that, I’m just overwhelmed that we’re even right here.

Nick Schenck: [00:52:12] Yeah. Yeah. Well, cool.

Edward Floyd: [00:52:14] But just know that that number is higher than, than where I expect it for 2021.

Nick Schenck: [00:52:21] I’m guessing you’re in like the $200k, $300k range is my guess.

Edward Floyd: [00:52:25] A little bit less than the $200k in that $100k to $200k.

Nick Schenck: [00:52:28] Okay. Um, all right. For people listening who have thought about launching their own tech company or any type of business, um, what advice would you give them?

Edward Floyd: [00:52:42] Um, yeah, the biggest advice I can give them is try to find a way to do what you want to do with no money.

It sounds crazy. It sounds crazy. And I don’t mean like, you know, get investors who invest in your idea, like figure out how to make it work with no money, meaning that you’re using your money to start. It’s easy to build up and scale up than it is to try to jump from the top and then bring it back down to save money.

Nick Schenck: [00:53:15] Yup. Okay. So for people listening who want to download the app or learn more about Spirit Tree, how can they do that?

Edward Floyd: [00:53:26] Yeah. So you can actually download the app, you know, in both stores. Um, you can actually shop with us at SpiritTree.com and you can also follow us on Instagram @spirittreeapp. And that’s where you can see everything that we’re doing and just kind of grow with us as we’re growing.

Nick Schenck: [00:53:43] Awesome, man, I really appreciate you, um, opening up to us and sharing your story and, uh, we’ll get you on in the future. Um, you know, once you enter the hyper hyper growth stage with a thousand local businesses on the platform.

Edward Floyd: [00:54:00] Yeah. Yeah, can’t wait for that. Um, I might have to put you on the calendar as expected dates so I can contact Nick at this day.

Nick Schenck: [00:54:11] For sure, man. You know how to reach me. Thanks a lot for joining. I appreciate it. [/restrict]