Are you confident your Meta Advantage+ Shopping campaigns (ASCs) are generating truly incremental sales? Or is Meta taking credit for conversions that would have happened anyway?

Meta’s ASCs provide e-commerce brands with a valuable tool to leverage machine learning to identify and convert users into customers. But unlike other campaign types in Meta, where you manually designate a custom audience, interest audience, or lookalike audience to target ads (and you can add audience exclusions to narrow your delivery), ASCs limit advertisers’ ability to target specific audiences.

Instead, Meta allows advertisers to automate audience targeting in ASCs by determining what percent of their budget is spent on existing customers. Otherwise, ad delivery on ASCs is intentionally broad and then narrows as Meta detects buying signals that allow it to hone in on the right audience(s).

Methods To Verify Advantage+ Shopping Campaign Targeting

With ASCs in particular, suspicions about incremental purchases are amplified because advertisers may have the false impression that they’re reaching users high in the purchase funnel when they reduce the budget for existing customers.

Here are the proven strategies that we use to help clients gain better visibility into the audience(s) we are targeting and where they sit in the purchase funnel.

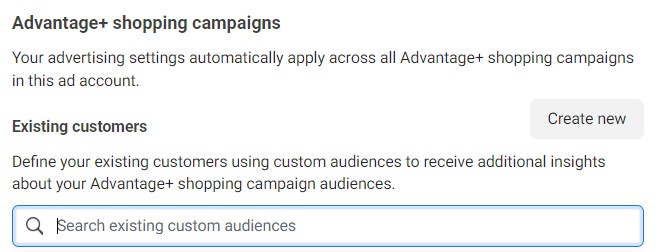

Meta Ad Account Settings

In setting up ASC campaigns, we define the existing customers in the ad account settings. Ideally, this custom audience will update dynamically through an integration with Klaviyo or another email service provider.

Defining the existing customer audience allows us to cap the budget we spend advertising to existing customers, and this allows us to see reporting breakdowns between new and existing customers.

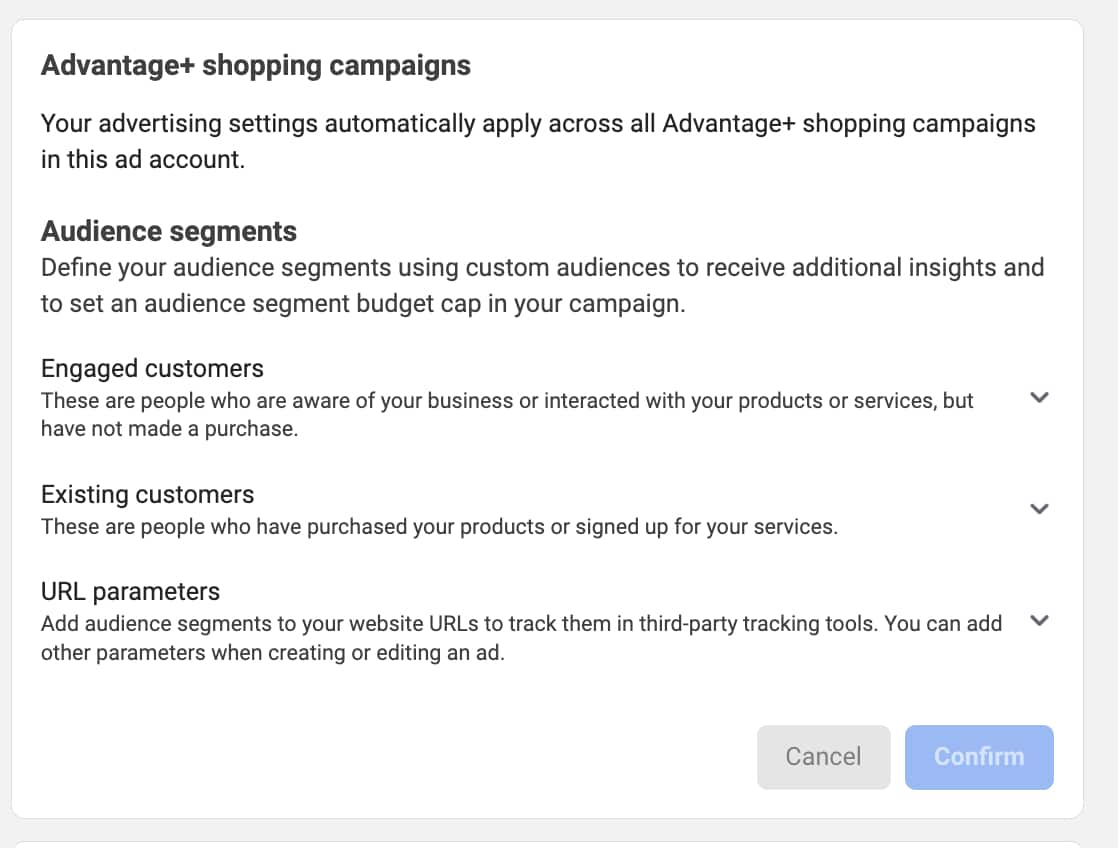

Meta Audience Segments

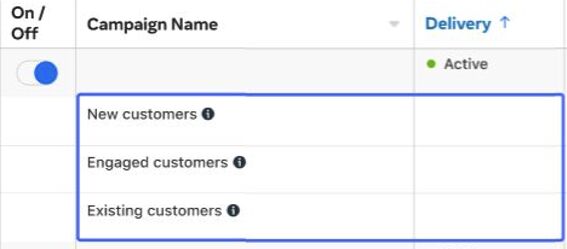

Once the ASC is running, we monitor the performance between the new and existing customer segments. To view this, click on “Breakdown” in Meta Ads Manager in the Campaigns view, and then select the “Audience segments” checkbox.

We make sure the ASC budget spent on existing customers matches what we set for the campaign, and we also observe how purchases differ between the audience segments. If 90 percent of the purchases come from the existing customer segment despite only 10 percent of the budget spent reaching those users, that is a relevant data point.

But even if 90-100 percent of the purchases are coming from the new customer segment, you may still be reaching people far down the purchase funnel:

- Email subscribers who haven’t purchased

- Website visitors

- People who have engaged with your brand on social media

Fortunately, Meta is rolling out a new engaged customer segment, which consists of “people who are aware of your business or interacted with your products or services, but have not made a purchase.” You can decide who fits this definition by uploading custom audiences of people who fit that criteria.

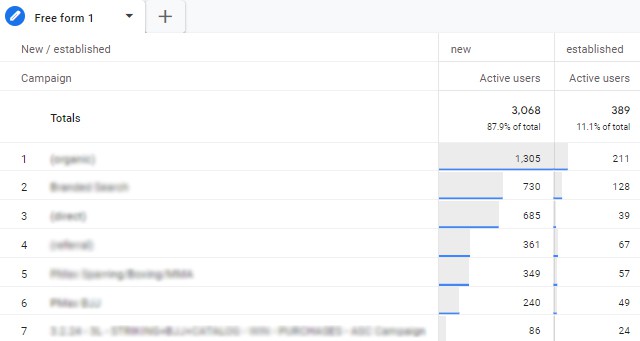

GA4 User Reports

A third-party approach to verifying ASC traffic is helpful as a sanity check. In GA4, we follow these steps to look at how ASC traffic breaks down between “new” (first visit in the last 7 days) and “established users” (first visit was > 7 days ago).

- In GA4, navigate to “Explore” and click on “Free Form”

- Select the date range in the top left corner

- In Rows, filter by the “Campaign” dimension

- In Columns, filter by the “New/Established” dimension

- In Values, filter by the “Active users” metric

In this report, you can see what percent of the active users attributed to your ASC campaign(s) are new vs. established. A red flag would be if your ASC campaign is set to target only new customers (e.g. budget cap on existing customers is set to zero), but 90 percent or more of the traffic attributed to the campaign is coming from established users. This would indicate that your campaign is largely reaching people already familiar with your brand, when your intention was to “grow the pie,” so to speak.

This can happen if you set a low cost per result goal in the ASC, which can cause Meta to prioritize ad delivery to people who are already within your brand’s orbit because their likelihood to convert is higher than people in the upper stages of the purchase funnel. So in this scenario, raising your cost per result goal may open up new audiences.

Other Considerations For Advantage+ Shopping Campaigns

It may be tempting to game the system.

For instance, instead of uploading your existing customer list in Ad Account Settings, you could upload a list of your entire email database. Then you could cap your ASC budget at 10 percent on “existing customers” to ensure that your ASC spends only a small budget on users in your email database, including past customers.

We don’t recommend this approach for a few reasons (in no particular order):

- If the idea is to reduce ASC delivery to email subscribers in order to reach folks higher in the purchase funnel, there are other ways to achieve this through bid or budget adjustments.

- When you filter by Audience Segments, you now have to remember that purchases from existing customers could include email subscribers (or however you want to define your existing customer list) and not necessarily past purchasers.

One valid reason to expand your existing customer audience beyond past purchasers is if you don’t have many previous customers. In that case, Meta’s machine learning won’t have a lot of data to leverage to find other users who fit the same (or similar) characteristics as your target consumer.

Lastly, for some advertisers, it makes sense to run ASCs targeting a significant percentage of existing customers. Perhaps your brand has a low repeat purchase rate, or maybe your email delivery rate is low and you aren’t reaching a lot of past purchasers through non-paid channels.

As always, do what works best for your brand.

Need help optimizing your paid social or paid search campaigns? Reach out to us at [email protected] for a consultation.